|

| Source: Bloomberg |

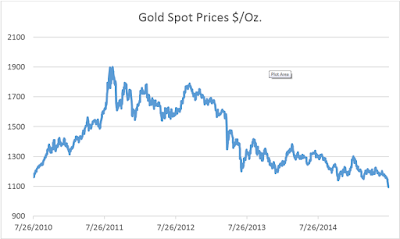

The most

recent declines over the past 10 days may be attributed to a few factors, in

our view:

- China gold reserves was up 57%, only half of what was expected by the market, with its share of total reserves in decline.

- The markets continue to anticipate a hike in US interest rates this year by the Federal Reserve, moderating the appetite investors have for non-yielding assets like gold and also fueling concerns that borrowing costs for holding such assets may rise.

- Geopolitical crises, such as Greece and the US reaching a deal with Iran, seem to be moderating, thus, calming investor fears which would send them into defensive assets like gold.

Africa accounts for a fifth of global gold exports, according to the African Development Bank, and, of the key markets in Africa, South Africa accounts for 10% of global gold exports. (The others are Ghana at 17%, Mali and Tanzania at 9% each, and the rest of Africa at 15%.) We note, however, that, whereas in 1983 South Africa produced 64% of the world’s supply (21 million tonnes), in 2014 the country produced only 6% of supply (5 million tonnes). Also, despite the fall in gold prices, the benchmark equity index for South Africa has almost tripled since 2011 relative to the price of bullion. The potential damage to South Africa from falling gold prices seems to be well under control, in our opinion, again pointing to the need for investors to follow an active management strategy when investing in Africa.

Nile Capital Management

We Know Africa: From Cairo to Cape Town

For more information please call 646-367-2820

No comments:

Post a Comment