After substantial

discussion on the Street and volatility across global markets, the Fed chose to

ignore the noise and announced that it will not be raising interest rates at

this time. We say good for the Fed!

In our view, the Fed was

essentially put in a no-win situation, so chose to ignore the noise and focus

on fundamentals. Raising rates by 25 basis points makes no sense in terms of

the fundamentals of the US economy; plus, further strengthening of the dollar

will not help global markets over the long-term despite any near-term relief

rally. Keeping rates unchanged may induce continued volatility across markets,

but, in our view, the Fed did the right thing, and investors should consider

such volatility as an attractive buying opportunity.

In our view, we think future

rate hikes are highly unlikely until the second half of 2016 for a variety of

reasons. For one thing, politics. 2016 is an election year. So, unless

absolutely needed, why mess with the economy and the markets? On the other

hand, by late 2016, with the Obama administration on its way out, a rate hike

of 25 to 50 basis points could be the signal of a successful presidency. The

president entered office at a time the country was hurting from a financial

meltdown and could be exiting at a time of a much strengthened economy where a

small rate hike could be justified as a new turn in monetary policy. For

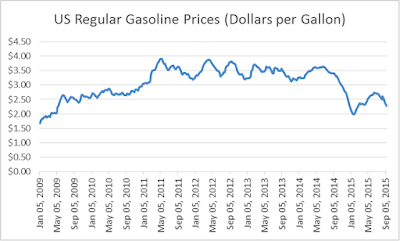

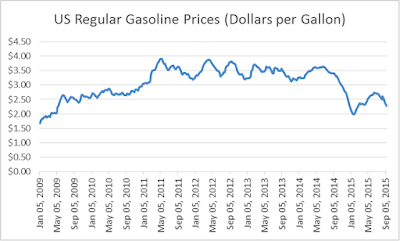

another thing, inflation trends. The August 2015 Inflation rate was 0.2%,

versus the Fed target of 2% for a rate hike. Gas prices are a big factor

driving the moderated inflation rate, with prices at the pump down 1%

year-over-year. Unless a significant shortage suddenly erupts perhaps due to

disruption in the Middle East, we do not foresee a major reversal of the trend.

Note that gas prices today are roughly in line with prices in 2009, though with

the US economy and the US consumer in a much stronger position.

|

Source: US Energy Department.

|

In terms of how the Fed

views a sluggish Chinese economy (or, for that matter, any economy outside the

US), we think that this week’s decision suggests that the US economy still

remains the Fed’s focus. That is how it has always been when the world was

dominated by the economies of the US and Western Europe – and that is how the

Fed will continue to operate even as other economies bloom. And we agree with

that philosophy.

Now, in terms of where to

invest, we reiterate once again: take advantage of the market volatility to

diversify portfolios. Market behavior is cyclical, and valuations in Africa

and other frontier and emerging markets have come down nicely. So take this

opportunity to allocate to actively managed funds focused on those

regions.

The views expressed are opinions subject to

change and are not investment advice

We Know Africa: From Cairo to Cape Town

For more information please call 646-367-2820