In a report recently released by Ernst & Young, the global accounting firm has predicted that foreign direct investment in Africa could reach $150 billion by 2015 (from $84 billion in 2010). The report noted that Africa is becoming increasingly attractive as international investors seek new opportunities for growth, and pointed out that “while Africa’s challenges are well documented, there is an increasing recognition that the continent is on an upward trajectory; economically, politically, and socially.”

The report most notably highlights a study of the perception and outlook of a panel of 562 decision makers from around the globe. The individuals surveyed where, according to E&Y were “divided into six main sectors” and “representative of the key African and global economic sectors,” these sectors are:

industry/automotive/energy

services, consumer products

raw materials

real estate/construction

hi-tech/telecom

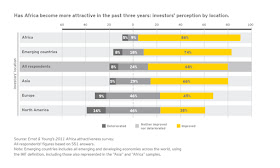

The results of this survey are quite telling. Of those surveyed, 86% said that they believed Africa has become more attractive over the past three years – greater than the 66% increase for Asia, and 45% and 38% respectively for Europe and North America. In addition, 88% of respondents believe that Africa will become more attractive over the next three years, versus 79% for Asia, 53% for Europe, and 60% for North America.

Of perhaps even greater interest is the perception of Africa going forward. 88% of survey respondents claim that over the next three years they believe Africa’s attractiveness will improve. In contrast, only 60% of respondents believe North America will become more attractive in the next three years, and 53% believe Europe will. Even Asia lagged Africa, with 79% of respondents believing it will get better, but 18% expecting it to not change (compared with 8% for Africa).

Finally, the survey also attempted to quantify respondents’ intentions for business in the continent, with similarly upbeat results. Of those surveyed, 43% said that they plan to invest in Africa in coming years, and an additional 19% plan to maintain operations.

Of course, 29% of respondents also said that they have no plans in coming years to invest in the continent. Common concerns amongst these respondents focused on the political, regulatory, and social environment, as well as infrastructure challenges and difficulty accessing customers. These of course do remain valid concerns, however we believe that these barriers have steadily shifted downwards, and will continue to do so.

For example, we believe that urbanization is a natural catalyst for entry into new consumer markets (read more here). As the population of Africa’s cities swells, they become increasingly compelling markets for firms looking to establish a presence on the continent. Infrastructure can be a concern (read here), however we have seen substantial progress made there as well, as well as opportunities for investment in further infrastructure development.

Political challenges of course remain. It is often easier to discuss Africa as a compelling investment broadly. However, the true opportunity lies in understanding the diversity of Africa’s myriad nations and capital markets, and actively seeking compelling investments within them. In Africa’s 53 nations and 24 capital markets there are a spectrum of opportunities and challenges to understand and manage. However, the perception of Africa broadly having an ‘unstable political environment’ unfairly lumps the good with the bad. This of course presents an opportunity for Nile, as we focus on investing in select countries where we see the best risk/reward ratios. It is also an attitude that many not necessarily persist. As the opportunity for investing in Africa’s various nations becomes more fully understood, we expect the proportion of firms who invest in the continent to continue to rise.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 info@nilecapital.com.

We know Africa - from Cairo to Capetown.

Thank you for this most impressive article. This past week, I was researching direct foreign investments and will use this article in my dissertation. Great compliment to what I have already found.

ReplyDeletePerhaps of interest to you and others would be in the following paper. My topic is globalization and International Student population. However, the bottom line is Revenue/Expenses and Profit/Loss, and the impact of the current global recession.

THE COSTS AND BENEFITS OF GLOBALIZATION IN LIGHT OF THE RECENT RECESSION IN THE AMERICAN ECONOMY

Adil H. Mouhammed, University of Illinois at Springfield, USA

Why not education included. Its the ground of the economical growth ?

ReplyDeleteGood work. Thanks.