Recently, South Africa has been in the news for its invitation to the third summit meeting of the BRIC club – a group named after its members’ initials (Brazil, Russia, India, China) which for many investors has represented the most compelling opportunities in Emerging markets over the past decade. The invitation of South Africa changes this group to the BRICS, and represents a diplomatic victory for President Jacob Zuma.

However, the invitation left some scratching their heads, as South Africa’s relative size and growth makes it a less significant player in the global market than its larger companions. South Africa’s population is estimated to be around 50 million residents – a substantial number, but only enough to make it the 25th largest country by population. In comparison, Russia has 139 million residents, Brazil has 203 million, India has 1.2 billion, and China has 1.3 billion – all substantially more than South Africa alone. The economies of the original BRIC countries are also substantially larger – Brazil and Russia’s GDPs exceed $2 trillion, India’s exceeds $4 trillion, and China’s is approaching $10 trillion. South Africa’s economy is comparably small at just over $500 billion, and is expected to grow at a relatively modest rate in coming years.

Given all this, including South Africa as a ‘BRIC’ economy on its own may seem counterintuitive, especially when countries like Mexico, Turkey, or even Indonesia are larger on a population and GDP basis. However, we believe South Africa’s inclusion makes absolute sense, as South Africa is an excellent gateway for investment across Africa as a whole.

Many investors agree that the opportunity for investment in various sectors and economies across the continent is substantial. However, we often hear that barriers to entry for businesses in Africa are typically high. At times, companies that see opportunity in Africa face legal and logistical challenges in establishing and maintaining operations as well as building markets for their products in Africa’s various (and varied) economies. In order to combat this challenge, many companies are choosing to work through South Africa in establishing a presence on the continent.

Take for example the recent purchase of Massmart by Wal Mart. Wal Mart has chosen to establish a presence in Africa via an existing firm in order to take advantage of its experience in the South African market. However, from an investor’s perspective the opportunity for Wal Mart is not limited to South Africa. Rather, Massmart is a compelling acquisition because it is well positioned to expand into the remainder of the continent. As we have previously written, the opportunity for retailers to tap into Africa’s growing consumer class is substantial, and firms that are able to be at the forefront of the trend could see substantial rewards. Many South African firms are thus positioning themselves as market leaders in telecommunications, banking, retail, and other industries where growth is expected to be strong.

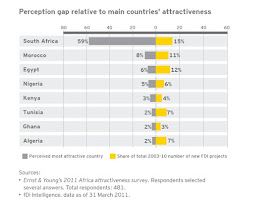

In addition, South Africa is often used as a base for natural resource firms which operate in other parts of the continent. South Africa’s regulatory environment is well developed and transparent, and often serves as a good base of operations. In fact, recent tax law changes in South Africa have demonstrated the country’s desire to be a gateway to the rest of Africa. In many ways South Africa’s regulatory environment is more similar to that of the developed world than its fellow BRIC economies. As a recent Ernst & Young study indicates, many investors’ perception of the various large economies in Africa strongly favors South Africa for its attractiveness - 59% of the survey’s respondents see South Africa as the ‘most attractive’ country for investment in the continent.

However, the invitation left some scratching their heads, as South Africa’s relative size and growth makes it a less significant player in the global market than its larger companions. South Africa’s population is estimated to be around 50 million residents – a substantial number, but only enough to make it the 25th largest country by population. In comparison, Russia has 139 million residents, Brazil has 203 million, India has 1.2 billion, and China has 1.3 billion – all substantially more than South Africa alone. The economies of the original BRIC countries are also substantially larger – Brazil and Russia’s GDPs exceed $2 trillion, India’s exceeds $4 trillion, and China’s is approaching $10 trillion. South Africa’s economy is comparably small at just over $500 billion, and is expected to grow at a relatively modest rate in coming years.

Given all this, including South Africa as a ‘BRIC’ economy on its own may seem counterintuitive, especially when countries like Mexico, Turkey, or even Indonesia are larger on a population and GDP basis. However, we believe South Africa’s inclusion makes absolute sense, as South Africa is an excellent gateway for investment across Africa as a whole.

Many investors agree that the opportunity for investment in various sectors and economies across the continent is substantial. However, we often hear that barriers to entry for businesses in Africa are typically high. At times, companies that see opportunity in Africa face legal and logistical challenges in establishing and maintaining operations as well as building markets for their products in Africa’s various (and varied) economies. In order to combat this challenge, many companies are choosing to work through South Africa in establishing a presence on the continent.

Take for example the recent purchase of Massmart by Wal Mart. Wal Mart has chosen to establish a presence in Africa via an existing firm in order to take advantage of its experience in the South African market. However, from an investor’s perspective the opportunity for Wal Mart is not limited to South Africa. Rather, Massmart is a compelling acquisition because it is well positioned to expand into the remainder of the continent. As we have previously written, the opportunity for retailers to tap into Africa’s growing consumer class is substantial, and firms that are able to be at the forefront of the trend could see substantial rewards. Many South African firms are thus positioning themselves as market leaders in telecommunications, banking, retail, and other industries where growth is expected to be strong.

In addition, South Africa is often used as a base for natural resource firms which operate in other parts of the continent. South Africa’s regulatory environment is well developed and transparent, and often serves as a good base of operations. In fact, recent tax law changes in South Africa have demonstrated the country’s desire to be a gateway to the rest of Africa. In many ways South Africa’s regulatory environment is more similar to that of the developed world than its fellow BRIC economies. As a recent Ernst & Young study indicates, many investors’ perception of the various large economies in Africa strongly favors South Africa for its attractiveness - 59% of the survey’s respondents see South Africa as the ‘most attractive’ country for investment in the continent.

In addition, it should not be overlooked that the invitation for South Africa was a strategic decision by the other BRIC members. As trade between emerging markets (the so called south-south link) increases, the original BRIC members want to be perceived as open and welcome to South Africa, and the rest of the continent. Because South Africa is currently Africa’s largest market, it is often involved in the preponderance of these south-south flows. Thus, including South Africa in the BRIC club is a sign that the other members want to do business with the continent.

Therefore, while South Africa viewed independently may not seem like an opportunity which is comparable to the other BRIC economies, Africa as a whole is an opportunity on the same scale as India or China. It’s inclusion in the BRIC club is thus a harbinger of Africa’s growing role in the Emerging Markets, and its importance for Emerging Market investors.

It makes perfect sense for BRIC to become BRICS.. this has been on the cards for a while now and should be very positive for a number of firms in SA. Hopefully the givernment will make it easier for international investors to allocate to funds in SA with the tax changes expected in Jan 2012 so fund managers can then use this additional capital to drive the nation.

ReplyDelete