To many, Africa is perceived as a place full of poverty, with its residents scratching out a living and barely feeding their families. Although poverty is a significant and real concern in many parts of Africa (as well as Emerging markets as a whole – and the United States for that matter), Africa also has a robust and growing consumer class which, according to McKinsey, had a combined spending power of $860 billion in 2008. This number, which has been growing robustly for years is expected to rise to $1.4 trillion by 2020, as population and economic dynamics make it possible for more Africans to increase their consumption of basic and discretionary goods and services.

As some background, you can see from the World Population Bureau’s 2010 datasheet here that there were over 1 billion people living in Africa as of mid 2010. That alone means nearly one in every seven people in the world currently lives in Africa. Nigeria, for example, is the eighth largest country in the world, with 158 million residents (compared to 310 million in the US).

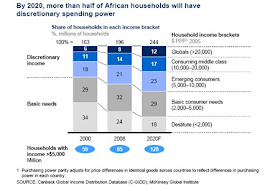

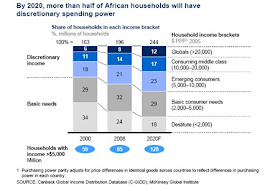

In terms of consumer spending power, economists like to break down income brackets which define consumers who satisfy their basic needs, and those with discretionary income. Generally, the $5,000 level in purchasin g power is used to define the point where consumers are able to go from satisfying their basic needs to spending on discretionary goods. As you can see (sourced from McKinsey) in 2000 there were approximately 59 million households in Africa with discretionary income to spend. By 2008 that number had jumped to 85 million, and by 2020 it is forecast to rise to 128 million – more than double in merely two decades.

g power is used to define the point where consumers are able to go from satisfying their basic needs to spending on discretionary goods. As you can see (sourced from McKinsey) in 2000 there were approximately 59 million households in Africa with discretionary income to spend. By 2008 that number had jumped to 85 million, and by 2020 it is forecast to rise to 128 million – more than double in merely two decades.

g power is used to define the point where consumers are able to go from satisfying their basic needs to spending on discretionary goods. As you can see (sourced from McKinsey) in 2000 there were approximately 59 million households in Africa with discretionary income to spend. By 2008 that number had jumped to 85 million, and by 2020 it is forecast to rise to 128 million – more than double in merely two decades.

g power is used to define the point where consumers are able to go from satisfying their basic needs to spending on discretionary goods. As you can see (sourced from McKinsey) in 2000 there were approximately 59 million households in Africa with discretionary income to spend. By 2008 that number had jumped to 85 million, and by 2020 it is forecast to rise to 128 million – more than double in merely two decades.

In addition to being a large consumer market presently, Africa also has an in credible amount of opportunity for growth. According to the World Population Bureau, Africa’s rate of natural increase in population is estimated to be 2.4% - meaning that by mid 2025 there will be an estimated 1.4 billion people living on the continent, and 2.1 billion by mid 2050. The chart below (also from the World Population Bureau) shows the ten countries with the highest population under 15 globally as of 2010: all but one are in Africa.

credible amount of opportunity for growth. According to the World Population Bureau, Africa’s rate of natural increase in population is estimated to be 2.4% - meaning that by mid 2025 there will be an estimated 1.4 billion people living on the continent, and 2.1 billion by mid 2050. The chart below (also from the World Population Bureau) shows the ten countries with the highest population under 15 globally as of 2010: all but one are in Africa.

credible amount of opportunity for growth. According to the World Population Bureau, Africa’s rate of natural increase in population is estimated to be 2.4% - meaning that by mid 2025 there will be an estimated 1.4 billion people living on the continent, and 2.1 billion by mid 2050. The chart below (also from the World Population Bureau) shows the ten countries with the highest population under 15 globally as of 2010: all but one are in Africa.

credible amount of opportunity for growth. According to the World Population Bureau, Africa’s rate of natural increase in population is estimated to be 2.4% - meaning that by mid 2025 there will be an estimated 1.4 billion people living on the continent, and 2.1 billion by mid 2050. The chart below (also from the World Population Bureau) shows the ten countries with the highest population under 15 globally as of 2010: all but one are in Africa.

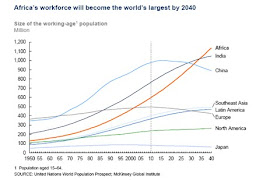

In fact, according to McKinsey, Africa’s workforce will be the largest in the world by 2040 – surpassing even India and China.

Even more surprising is the opportunity for penetration of new markets. Since the year 2000, McKinsey notes that 316 million new phone subscribers have signed up in Africa. However, they also note that in 2008 only 39% of Africa’s population had access to telecom services , 38% had access to modern retail, and 20% had access to banking (note that these statistics include South Africa, where the numbers are 92%, 68%, and 60% respectively, skewing the average up). It is amazing to think of the potential for growth in companies that are able to fill those gaps.

Thus, population growth and an emerging middle class mean that Africa is a compelling opportunity for consumer goods companies, especially given limited growth prospects in much of the developed world. Many companies have already realized this, and are beginning to capitalize on the trend. As we wrote earlier, the South African retail chain Massmart was recently purchased by Wal Mart, who hopes to use the brand to grow into the continent (read here). Many other companies are making similar strategic pushes.

What does that mean to us, who invest in African markets? Of course we at Nile understand the opportunity for growth in companies that effectively produce goods that suit African consumers’ needs. We see enormous opportunities in retail, food, housing, cellular phones, and financial firms that are well positioned to access the growing consumer market. We also believe that African companies are often uniquely positioned in the market, as they are able to bring local knowledge and branding power to their business model. We actively seek precisely these sorts of firms – ones which pair local knowledge with strong growth prospects and good valuations. In fact, consumer firms are one of our three main ‘themes’ (infrastructure and natural resources are the others) for investing in African markets.

To answer our earlier question – the consumer market is large, growing, maturing, and - in many cases – relatively untapped. Not a bad place for long-term investors to be.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

I agree there are significant opportunities in Africa. Some perspective on the size of these opportunities, however, is useful. Here are a few quotes from a 2007 book "African Development", by Todd Moss (p. 12-13).

ReplyDelete"Africa may loom large in certain development circles, but it is a tiny player on the global stage. Twenty African countries each have a total population of less than 5 million people, about the size of metropolitan Washington, DC. Botswana features prominently in the development literature (including this book) but it is a small country of mostly desert and swamps with only 1.7 million people. African economies are even more minuscule relative to the global marketplace. The economies of all forty-eight African countries combined are about the same size as Chicago's. The county in which I live (Montgomery County, Maryland, next to Washington, DC) has a larger GDP than forty-six different African countries (South Africa and Nigeria are bigger). Even my town (Bethesda, population about 55,000) has an annual income greater than twenty-four African economies. These comparisons are worth recalling the next time you hear that a multinational corporation just cannot wait to pry open some untaped African market."

We all know measurement is iffy in these informal economies and how Moss counted only 48 countries on the continent is unclear. Despite my own personal enthusiasm for Africa, which many share, I appreciate relative comparisons and find this passage enlightening.

Hi Joel - thank you for your comment.

ReplyDeleteWe do not dispute that many of the markets in Africa are relatively small or have relatively little purchasing capacity. However, I would make two rebuttals - first, in this case there is an argument to be made for the opportunity as a whole. Although there are plenty of small nations in Africa (as there are plenty of small states in the US) it does not refute the point that the overall market is quite large, and growing rapidly.

Second, again, it is useful to look at growth in many of these economies rather than their baseline size. As equity investors, we are interested in companies that can expand their businesses such that they will achieve good returns in their stock performance. Larger consumer markets are thus the more obvious opportunity, but it does not eliminate the potential for opportunities across the continent.

I would also point out that even if Bethesda has a greater income than 24 African economies (we haven't verified this, but will accept it for the sake of argument) that still leaves over 50% of the 53 nations in Africa. A good deal of America's population (and thus consumer spending) is concentrated in a handful of states, but that does not mean that investors ignore the remainder. In fact, a quick search indicates that 11 US states have fewer residents than the figure quoted for Botswana, yet we would never say there are no opportunities for investments in Delaware or New Hampshire.

Despite the continent-wide story, opportunities are largely compartmentalized within countries. Efforts at regionalization remain modest and most businesses have difficulty crossing borders, for a variety of reasons.

ReplyDeleteLarry himself said in the Feb 20th Wychick interview, posted on this blog, that "Africa has to be seen from a country by country basis".

"Africa has to be seen from a country by country basis". That's the whole thing I have been talking about. It always makes me sick when people start talking about Africa as though it was just a country. 53 countries each with their language, culture and mentality. Ignore this at your own peril...

ReplyDeleteAfrica is too diverse to discuss under a single heading of "Africa". Joel is 100% correct in his assertion that Africa must be examined country by country.

ReplyDeleteMoreover, Africa has barriers to entry and barriers to trade which make intra-continental business a nightmare (we operate in 5 african jurisdictions) at present.

Even regional groupings, like SACU, SADC etc, which are supposedly supposed to advance trade, are inherently hostile thereto and are headed by leaders that are protectionist and stuck in 1970s socialist literature (i.e. they are fundamentally opposed to free trade and capitalism).

In this regard, see S-Africa's opposition to the Walmart deal (purchase of Massmart) as a case in point. SA desparately needs FDI but Govt (and its Trade Union "allies") appear hellbent on scuppering the deal...

Africa is complex and infuriating but it does offer massive opportunity for those brave and skilled enough to surmount its numerous challenges.

What is key for Africa (not just SA) is the political arena to change. FDI has changed politics in several countries - even the communist China, so Africa will not be left behind I think. There is no logic in talking about the small size of individual countries or the large size of the continent, or the diversity of each country etc...See, there are enough examples in the world to defy the above arguments - Qatar is very small and ruled by a dynasty, yet very rich with excellent standard of living, India is very big, diverse with over 175 languages, many religions and tribes, and is democratic (which actually means, not easy to rule!), yet the economic compulsions presented to it in 1990 left no option to the political parties - whether Left, Centre or Right!

ReplyDeleteSo, I see a great potential in Africa as a whole, but without political will, all of it is a non starter. SA's resistance to WallMart is a good example in this regard.

Unfortunately even the country level is too macro, and while there are specific national policies which may be appropriate to consider, ultimately the real opportunities lie within specific regions, and then within specific groups within those regions. The segmentation discussed in the McKinsey report last June was a helpful breakdown, but in countries similar to Ethiopia, Addis Ababa might as well be a different country than Dire Dawa, the 2nd main city to the East.

ReplyDeleteThat's not to argue that the consumer potential is not tremendous, but the truly effective and profitable solutions to capturing or unlocking that value is going to be granular, local and highly tailored to segments within an area, within the country, within the region, etc.