In an article in the Economist over the weekend (read here), the magazine profiles the less-than-favorable perception among many Africans of China's investments in their economies. The magazine notes that “once feted as saviours in much of Africa, Chinese have come to be viewed with mixed feelings—especially in smaller countries where China’s weight is felt all the more. To blame, in part, are poor business practices imported alongside goods and services.” The article points out that construction projects which are completed by Chinese firms – often a ‘tied’ requirement for low cost Chinese loans – are frequently of low quality. Also, labor practices among Chinese firms are frequently perceived as corrupt or draconian.

The article notes that the political backlash in many African nations has been significant, with many African leaders pushing for greater scrutiny and improvement of practices. However, it also quotes a former senior official at the African Development Bank who claims that “more Chinese have come to Africa in the past ten years than Europeans in the past 400.” We had noted previously that China was undoubtedly going to remain a major player in Africa, although we see other Emerging nations in particular as working to expand their role. However, as we mentioned in a recent article Africa’s governments are becoming more sophisticated in their ability to negotiate with foreign investors, with many recent contracts requiring infrastructure investments and local employment as a condition of new deals. Ironically, these infrastructure projects have been one reason for the recent influx of Chinese workers in the Continent, and have in some cases led to greater scrutiny of their business practices.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

About Money Watch Africa

▼

April 25, 2011

April 21, 2011

Production in Africa: Moving Up the Value Chain

In our continued effort to distill what was discussed at the African Investment Conference put on by Institutional Investor Magazine, we wanted to highlight the emphasis which was placed on Africa’s potential for moving up the production value chain. In many cases, African economies can be (often falsely) perceived as dominated by natural resources or agricultural products alone. Although this perception is often overstated, it is true that commodities and agriculture remain the majority of Africa’s exports to the remainder of the world. However, there is enormous potential for investment in productivity and technology that could transform the composition of a number of African economies. To us, this process has already begun in many countries and sectors across the Continent, as savvier governments, growing economies, and more capital and expertise have made it possible for movement up the ‘value chain.’

Briefly, the ‘value chain’ is the idea of bringing raw or unfinished goods closer to a final, finished product. In each step of this process, the value of the good which is produced (and therefore the price for which it is sold) increases, often substantially. For example, in the production of a cotton shirt, a number of steps must be taken for raw cotton to be transformed into a finished product:

Raw Cotton -> Processed Cotton ->Thread -> Fabric -> Shirt

This (simplified) diagram demonstrates a basic value chain. In this example, raw cotton would be sold at a price which is significantly lower than processed cotton, et. cetera, with companies profiting at each step from the improvements they make. Thus, a company which processes cotton will buy raw material, and sell an improved good for a profit. Industries which are built on bringing goods up a step in this process often provide higher paying sustainable jobs, economic growth, and increased profit potential, as well as help diversify an economy away from basic materials into more ‘value add’ industries.

In terms of Africa, we see a great deal of potential for movement up the value chain. As we mentioned before, Africa is a major producer of a number of raw goods, which are often exported to other countries for improvement. This is problematic for a number of reasons: for example, the value which is added during the processing of a raw material is lost if the processing happens abroad, as are the highly skilled (and higher wage) jobs this processing requires.

Although each country is unique, Africa as a whole has been historically perceived as a poor place for investment in value added processes or vertical integration. In many cases, a history of corrupt governance, coupled with low levels of expertise and limited infrastructure have often made it difficult for business ventures to be successful, which has made investors wary of allocating capital to the region. In addition, domestic demand for many goods and services has historically been too low to justify the development or relocation of production facilities.

However, we believe that the historical view of many African nations’ potential for value addition should be revisited, as a number of catalysts have been developing which makes investment in these sectors more compelling. First and foremost, it is important to note that, in many cases, governance has improved substantially. Improvements in macroeconomic stability and the legal framework have often made the climate easier for businesses to be successful on the continent.

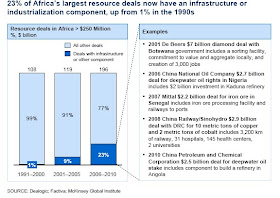

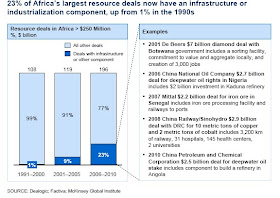

In addition, governments have become more sophisticated in negotiating deals with firms that are bidding for local contracts. In previous years, Africa’s natural resources were often extracted by foreign firms, which would remove raw goods from the continent and improve them elsewhere. However, in more recent years, governments have begun to require that extractive firms add infrastructure or value-add components to their bids for contracts. For example, as you can see in the chart below from McKinsey, from 1991-2000 only 1% of Africa’s largest resource deals had a component which included investment in infrastructure or industrialization. In contrast, that number grew to 9% between 2001 and 2005, and had risen to 23% in the period from 2006 until 2010.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

Briefly, the ‘value chain’ is the idea of bringing raw or unfinished goods closer to a final, finished product. In each step of this process, the value of the good which is produced (and therefore the price for which it is sold) increases, often substantially. For example, in the production of a cotton shirt, a number of steps must be taken for raw cotton to be transformed into a finished product:

Raw Cotton -> Processed Cotton ->Thread -> Fabric -> Shirt

This (simplified) diagram demonstrates a basic value chain. In this example, raw cotton would be sold at a price which is significantly lower than processed cotton, et. cetera, with companies profiting at each step from the improvements they make. Thus, a company which processes cotton will buy raw material, and sell an improved good for a profit. Industries which are built on bringing goods up a step in this process often provide higher paying sustainable jobs, economic growth, and increased profit potential, as well as help diversify an economy away from basic materials into more ‘value add’ industries.

In terms of Africa, we see a great deal of potential for movement up the value chain. As we mentioned before, Africa is a major producer of a number of raw goods, which are often exported to other countries for improvement. This is problematic for a number of reasons: for example, the value which is added during the processing of a raw material is lost if the processing happens abroad, as are the highly skilled (and higher wage) jobs this processing requires.

Although each country is unique, Africa as a whole has been historically perceived as a poor place for investment in value added processes or vertical integration. In many cases, a history of corrupt governance, coupled with low levels of expertise and limited infrastructure have often made it difficult for business ventures to be successful, which has made investors wary of allocating capital to the region. In addition, domestic demand for many goods and services has historically been too low to justify the development or relocation of production facilities.

However, we believe that the historical view of many African nations’ potential for value addition should be revisited, as a number of catalysts have been developing which makes investment in these sectors more compelling. First and foremost, it is important to note that, in many cases, governance has improved substantially. Improvements in macroeconomic stability and the legal framework have often made the climate easier for businesses to be successful on the continent.

In addition, governments have become more sophisticated in negotiating deals with firms that are bidding for local contracts. In previous years, Africa’s natural resources were often extracted by foreign firms, which would remove raw goods from the continent and improve them elsewhere. However, in more recent years, governments have begun to require that extractive firms add infrastructure or value-add components to their bids for contracts. For example, as you can see in the chart below from McKinsey, from 1991-2000 only 1% of Africa’s largest resource deals had a component which included investment in infrastructure or industrialization. In contrast, that number grew to 9% between 2001 and 2005, and had risen to 23% in the period from 2006 until 2010.

In addition, as industrialization increases the availability of better jobs in Africa, it also signifies the expansion of the middle class, creating greater domestic demand. This cycle reinforces itself, and as the African consumer class grows (and urbanization facilitates entry points in the retail market), demand for domestic production will grow as well.

So again, we return to what this means for how Nile looks at investing in Africa. We believe that there are a number of opportunities for selective investors to capitalize on the growth these catalysts will create. First, and perhaps most direct, there are gains to be made by investing in companies who are on the forefront of this trend. For example, firms that are investing in goods and services which satisfy growing domestic demand could have substantial potential. We seek to identify industries and firms which are investing in sectors where growth will be strong. This could include firms which are producing goods for export, but we also see potential in companies which are looking to capitalize on Africa’s growing consumer class (read more here).

However, there are also a number of opportunities for less direct investments which could capitalize on this trend. We had previously written about investing in infrastructure firms (read here), which we see as one of the key opportunities in Africa at this point. A firm which is able to provide infrastructure needs such as power and transportation makes it easier for these ‘value add’ sectors to develop and grow. In addition, opportunity may be found in financial firms which provide capital for emerging firms and industries to grow. These financial institutions tend to have a good local knowledge base and may generate substantial profits in tandem with the companies they fund.

As Africa’s infrastructure improves and its demand for more and better consumer goods continues to grow, we continue to believe that the opportunity for investment in the Continent remains substantial, and we are actively seeking ways to invest in companies that are well positioned to take advantage of it.For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

April 18, 2011

African Opportunity: More Than Just The Headline Names

Last week, Nile Capital’s Larry Seruma was quoted in an article in the New York Times entitled “At Opposite Ends of Africa, Fear and Confidence in Markets,” which compared and contrasted opportunities for investment in Egypt and South Africa.

We found this dichotomy very interesting and insightful. However, as specialized Africa investors, we would like to caution against looking at African investment opportunities as existing in these two nations alone. There is no doubt that South Africa and Egypt are the economic powerhouses of the continent, and on a market cap basis account for a substantial majority of the public equity listings. Yet Africa is a continent with 53 countries, a number of which have active exchanges. An investor who limits his or her exposure to South Africa and Egypt would be similar to an investor who only considers New York and California when looking for opportunities in the United States. We at Nile take seriously our claim of being a ‘pan-African’ investment firm. Our Africa knowledge base spans the geography from Cairo to Capetown: that includes everything in between. You can see from our most recent Fund Fact sheet that while South Africa and Egypt are two of our higher exposures, they are by no means the only places we see opportunity. In fact, many of the less well known opportunities may have greater long term potential for growth. Thus, although we understand the emphasis on Africa’s largest markets, we want to be sure that investors don’t believe that they are the only places where opportunities can be found.

We have previously written about the turmoil in Egypt (read here), noting that investors should consider more than the headline risk when considering exposure to Egypt. We remain confident in our thesis that there is opportunity for a selective manager to do well in the Egyptian market. As we have said before, political turmoil in the Middle East could be seen as a buying opportunity for a long term investor both because of indiscriminate, fear-based selling, and the possibility that improved governance will be a positive in the long term.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

April 15, 2011

The Consumer Market In Africa – Just How Big is Big?

To many, Africa is perceived as a place full of poverty, with its residents scratching out a living and barely feeding their families. Although poverty is a significant and real concern in many parts of Africa (as well as Emerging markets as a whole – and the United States for that matter), Africa also has a robust and growing consumer class which, according to McKinsey, had a combined spending power of $860 billion in 2008. This number, which has been growing robustly for years is expected to rise to $1.4 trillion by 2020, as population and economic dynamics make it possible for more Africans to increase their consumption of basic and discretionary goods and services.

As some background, you can see from the World Population Bureau’s 2010 datasheet here that there were over 1 billion people living in Africa as of mid 2010. That alone means nearly one in every seven people in the world currently lives in Africa. Nigeria, for example, is the eighth largest country in the world, with 158 million residents (compared to 310 million in the US).

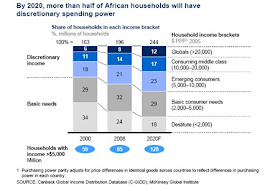

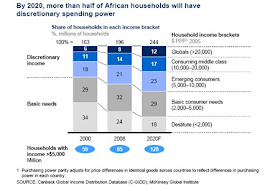

In terms of consumer spending power, economists like to break down income brackets which define consumers who satisfy their basic needs, and those with discretionary income. Generally, the $5,000 level in purchasin g power is used to define the point where consumers are able to go from satisfying their basic needs to spending on discretionary goods. As you can see (sourced from McKinsey) in 2000 there were approximately 59 million households in Africa with discretionary income to spend. By 2008 that number had jumped to 85 million, and by 2020 it is forecast to rise to 128 million – more than double in merely two decades.

g power is used to define the point where consumers are able to go from satisfying their basic needs to spending on discretionary goods. As you can see (sourced from McKinsey) in 2000 there were approximately 59 million households in Africa with discretionary income to spend. By 2008 that number had jumped to 85 million, and by 2020 it is forecast to rise to 128 million – more than double in merely two decades.

g power is used to define the point where consumers are able to go from satisfying their basic needs to spending on discretionary goods. As you can see (sourced from McKinsey) in 2000 there were approximately 59 million households in Africa with discretionary income to spend. By 2008 that number had jumped to 85 million, and by 2020 it is forecast to rise to 128 million – more than double in merely two decades.

g power is used to define the point where consumers are able to go from satisfying their basic needs to spending on discretionary goods. As you can see (sourced from McKinsey) in 2000 there were approximately 59 million households in Africa with discretionary income to spend. By 2008 that number had jumped to 85 million, and by 2020 it is forecast to rise to 128 million – more than double in merely two decades.

In addition to being a large consumer market presently, Africa also has an in credible amount of opportunity for growth. According to the World Population Bureau, Africa’s rate of natural increase in population is estimated to be 2.4% - meaning that by mid 2025 there will be an estimated 1.4 billion people living on the continent, and 2.1 billion by mid 2050. The chart below (also from the World Population Bureau) shows the ten countries with the highest population under 15 globally as of 2010: all but one are in Africa.

credible amount of opportunity for growth. According to the World Population Bureau, Africa’s rate of natural increase in population is estimated to be 2.4% - meaning that by mid 2025 there will be an estimated 1.4 billion people living on the continent, and 2.1 billion by mid 2050. The chart below (also from the World Population Bureau) shows the ten countries with the highest population under 15 globally as of 2010: all but one are in Africa.

credible amount of opportunity for growth. According to the World Population Bureau, Africa’s rate of natural increase in population is estimated to be 2.4% - meaning that by mid 2025 there will be an estimated 1.4 billion people living on the continent, and 2.1 billion by mid 2050. The chart below (also from the World Population Bureau) shows the ten countries with the highest population under 15 globally as of 2010: all but one are in Africa.

credible amount of opportunity for growth. According to the World Population Bureau, Africa’s rate of natural increase in population is estimated to be 2.4% - meaning that by mid 2025 there will be an estimated 1.4 billion people living on the continent, and 2.1 billion by mid 2050. The chart below (also from the World Population Bureau) shows the ten countries with the highest population under 15 globally as of 2010: all but one are in Africa.

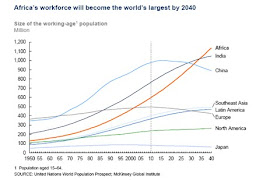

In fact, according to McKinsey, Africa’s workforce will be the largest in the world by 2040 – surpassing even India and China.

Even more surprising is the opportunity for penetration of new markets. Since the year 2000, McKinsey notes that 316 million new phone subscribers have signed up in Africa. However, they also note that in 2008 only 39% of Africa’s population had access to telecom services , 38% had access to modern retail, and 20% had access to banking (note that these statistics include South Africa, where the numbers are 92%, 68%, and 60% respectively, skewing the average up). It is amazing to think of the potential for growth in companies that are able to fill those gaps.

Thus, population growth and an emerging middle class mean that Africa is a compelling opportunity for consumer goods companies, especially given limited growth prospects in much of the developed world. Many companies have already realized this, and are beginning to capitalize on the trend. As we wrote earlier, the South African retail chain Massmart was recently purchased by Wal Mart, who hopes to use the brand to grow into the continent (read here). Many other companies are making similar strategic pushes.

What does that mean to us, who invest in African markets? Of course we at Nile understand the opportunity for growth in companies that effectively produce goods that suit African consumers’ needs. We see enormous opportunities in retail, food, housing, cellular phones, and financial firms that are well positioned to access the growing consumer market. We also believe that African companies are often uniquely positioned in the market, as they are able to bring local knowledge and branding power to their business model. We actively seek precisely these sorts of firms – ones which pair local knowledge with strong growth prospects and good valuations. In fact, consumer firms are one of our three main ‘themes’ (infrastructure and natural resources are the others) for investing in African markets.

To answer our earlier question – the consumer market is large, growing, maturing, and - in many cases – relatively untapped. Not a bad place for long-term investors to be.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

April 14, 2011

The ‘Infrastructure Tinted Lens’

Early in the first day of Institutional Investor’s Africa Conference Jay Ireland, the President and CEO of GE Africa (a recently created position), noted that he views opportunity in Africa through “infrastructure tinted glasses.” As Jay sees it, the opportunities for investment in Africa are largely driven by the Continent’s infrastructure needs. We had previously written about this issue as addressed by the World Bank’s Dr. Shanta Devarajan (read here), who noted that Africa would require an additional annual investment of $48 billion per year to bring Africa’s infrastructure to the level of Mauritius. We concur that investment in firms which operate in the African infrastructure space present a number of compelling opportunities.

Infrastructure in Africa can be perceived as both a challenge and an opportunity. As one of the conference’s other panelists noted, road density in Africa is about1/8th what it is in the BRIC economies (McKinsey’s Global Institute claims it is about 1/5th, but regardless, Africa is a clear laggard). McKinsey also notes that power generation in the BRICs is 2.4x that of Africa, and rail density is 2.3x higher. In addition, these numbers also don’t take into account the relative difference between South Africa and the remainder of the continent, for which the gap is significantly wider. Phone and cellular networks – although in many cases improving – remain spotty, and many Africans carry multiple phones in hopes of maintaining service from one place to another.

In addition, urbanization and population growth is putting a strain on many of Africa’s urban centers, where affordable and effective access to housing, water and sanitation, energy, and transportation remains a challenge. Also, the ability for countries to capitalize on natural resources and manufacturing is hampered by poor infrastructure networks. Even if an investor is looking at Africa from a traditional resource-based perspective, the cost of bringing goods to market – and therefore profitability – is directly linked to infrastructure networks that in many cases have not been adequately supported. Also, as African countries attempt to move into more manufacturing and intermediate or finished goods, access to the resources necessary to operate machinery will be a critical factor.

Presumably it is clear that investment in infrastructure is sorely needed on the African continent. However, in stark contrast with previous decades, a significant (and rapidly increasing) amount of capital is being put towards solving Africa’s infrastructure challenges. Perhaps it is not surprising to learn that, according to McKinsey, growth in transport and telecommunications grew by an annualized rate of 7.8% from 2002 until 2007, and construction grew at 7.5% annualized over the same period. For example, according to McKinsey, from 1991-2005 only about 1% of resource deals in Africa had an infrastructure component included. In contrast, that number had climbed to an average of 23% for the period between 2006 and 2010. In fact, McKinsey also predicts that between 2008 and 2020, revenue for infrastructure companies will grow by an annualized 9% rate, reaching over $200 billion by 2020, from approximately $72 billion today.

So what does that mean to us, who invest exclusively in opportunities in Africa? We have been adamant that infrastructure was a huge play for investors. We see great opportunities in many of the sectors mentioned above, as well as the companies which provide them with financing. In fact, we consider infrastructure companies to be one of the three key themes of our strategy, and actively position ourselves to seek companies that we believe will benefit from this trend. We absolutely understand why GE would see Africa through infrastructure tinted glasses – we do the same.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

April 13, 2011

Reflections From Institutional Investor’s Africa Conference

It is often difficult for opportunities in Africa to be understood by US investors. Notwithstanding the preponderance of data and evidence which suggests that Africa is on the cusp of a major developmental boom, it often seems challenging to explain that there is no better time to invest in Africa than today – except perhaps yesterday (or six months, or six years ago). Over the past decade, a composite of Africa’s markets have generated higher return than the S&P 500 and the MSCI Emerging Markets Index with less risk, as measured by volatility. It is sometimes hard to explain that the Africa of today is not what you might see in the headlines, or remember from years of sobering news reports. In fact, Africa is comprised of fifty-three unique nations, many of which have taken substantial and meaningful steps towards a prosperous future – and the numbers are there to prove it.

That being said, attending Institutional Investor’s conference on investing in Africa this week was a truly enjoyable way to spend the past two days. The conference brought together institutional and retail investors, business leaders, diplomats, and statesmen to discuss investing in Africa. All we can say is that we liked what we heard. Truth be told, we at Nile were not surprised by much of what was said. We have been saying all along that opportunities abound in Africa, not only in natural resources (which are plentiful), but in infrastructure, consumer goods, telecommunications, agriculture, financial services, housing, healthcare, and education, just to name a few. There are substantial returns to be made in Africa, and we hope to be able to help investors participate in the opportunity.

It would be possible to summarize what went on at the conference further, but we feel that many of the topics that were brought up deserve some real discussion. Therefore, we are going to hold you in suspense over the next few days, as we publish our thoughts on some of the biggest issues we believe were raised. Again, much of it may not surprise an investor who has been paying attention to Africa over the past few years, but it is likely to come as a shock to plenty of investors who have been looking elsewhere.

As a preview, here are the titles of our expected posts over the next week – stay tuned for more, and thanks again for all the delegates who made the event a good one – see you all next year!

1. The ‘Infrastructure Tinted Lens’

2. The Consumer Market – Just How Big is Big?

3. Moving Up the Value Chain

4. Risk management: Perception vs. Reality

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

April 5, 2011

Nile Capital's Thoughts on the First Quarter of 2011

Nile Capital has recently published its results for the first quarter of 2011, and we wanted to share some of our thoughts. Below are some excerpts from the quarterly report - for the full version, please request a copy at info@nilecapital.com

Performance in Africa's markets for the first quarter was challenged by the effects of political unrest, most notably in Egypt and Tunisia. The Egyptian market was closed from January 27th to March 23rd, and re-opened significantly lower than its January levels. Investors were thus adversely impacted by the correction, and a significant portion of weakness in Africa in the first quarter can be attributed to Egypt. However, although the political upheaval in Egypt caused short term turbulence in markets, we believe the long term impact of an improved and more stable political system will be beneficial for long term growth.

Overall, Africa's markets were mixed for the first quarter. Aside from Egypt and Tunisia, whose markets were down on political unrest, much of the Continent’s underperformance came from he larger markets of Nigeria and South Africa, where fund flows drove returns.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

Africa Region Fund Flows (%)*

Performance in Africa was also impacted by capital outflows from international markets, with stronger than expected US economic data encouraging investors to re-balance back to the US. As a result, fund flows to Africa t urned negative in the first quarter of 2011 but have since rebounded from off their lows. Fund flows had been vastly positive throughout the previous 12 month period, with substantial growth in the second half of 2010. Nevertheless, we continue to believe that growth will remain slow in Developed economies, and that expansion in Emerging Markets (and Africa in particular) will remain significantly better than in the Developed world.

urned negative in the first quarter of 2011 but have since rebounded from off their lows. Fund flows had been vastly positive throughout the previous 12 month period, with substantial growth in the second half of 2010. Nevertheless, we continue to believe that growth will remain slow in Developed economies, and that expansion in Emerging Markets (and Africa in particular) will remain significantly better than in the Developed world.

urned negative in the first quarter of 2011 but have since rebounded from off their lows. Fund flows had been vastly positive throughout the previous 12 month period, with substantial growth in the second half of 2010. Nevertheless, we continue to believe that growth will remain slow in Developed economies, and that expansion in Emerging Markets (and Africa in particular) will remain significantly better than in the Developed world.

urned negative in the first quarter of 2011 but have since rebounded from off their lows. Fund flows had been vastly positive throughout the previous 12 month period, with substantial growth in the second half of 2010. Nevertheless, we continue to believe that growth will remain slow in Developed economies, and that expansion in Emerging Markets (and Africa in particular) will remain significantly better than in the Developed world. Overall, Africa's markets were mixed for the first quarter. Aside from Egypt and Tunisia, whose markets were down on political unrest, much of the Continent’s underperformance came from he larger markets of Nigeria and South Africa, where fund flows drove returns.

Outlook

We believe our investment case for Africa continues to be underpinned by both global and regional growth dynamics. Although Advanced economies have outperformed Emerging and frontier markets in the first quarter of 2011, we believe that their long term growth is constrained by large fiscal and budget deficits, and these economies will have to raise taxes or cut spending to improve their fiscal conditions. In addition, monetary policy pursuing low short term interest rates (or ‘quantitative easing’) and dollar depreciation as a method to stimulate aggregate demand will lead to capital outflows to Emerging economies in search of higher yielding assets. As a result of these policy measures, we continue to believe Advanced economies will experience lower long term growth. Although in recent months positive data has implied a better than expected recovery in the US, the IMF believes that Advanced economies overall will grow by approximately 2.4% annualized over the next five years.

On the other hand, Africa’s growth is projected to be in excess of 5.4 % annualized in the next five years according to the IMF. In fact, the IMF has projected that Nigeria (the second largest Sub-Saharan economy) will experience GDP growth for the next five years in excess of 7% annualized, with the potential to do even better on the back of sustained high oil prices. A number of African countries have pursued stable monetary economic policies, and have better fiscal balances and low leverage. We believe this macroeconomic background continues to support the case for investing in Africa’s stock markets. In addition, we continue to believe that demand for natural resources and agricultural commodities, the need for infrastructure investment, and growing consumer demand will continue to be drivers on the continent. If anything, we feel that recent weakness presents a compelling opportunity for long term investors to enter Africa’s markets.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com.

We know Africa - from Cairo to Capetown.

*Chart sourced from EPFR