Please listen to Larry’s interview with Chuck Jaffe on the

Money Life Show. Larry provides his thoughts on investing in Africa.

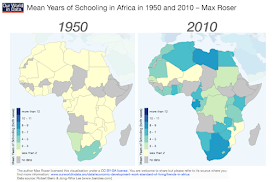

A few key points include:- The best way to think about Africa is as a frontier market with the benefit of emerging markets exposure underneath the surface. Frontier markets tend to be less liquid given less coverage by Wall Street – about 55 countries on the continent qualify as frontier markets. However, based on market capitalization, 2 countries on the continent (South Africa and Egypt) qualify as emerging markets.

- Active managers like Nile Capital Management

choose their investments in Africa on a country by country basis.

- In comparing Africa and BRIC, we believe Africa

has the advantage in terms of both valuation and growth potential. Less

coverage of African markets means lower multiples and bigger discounts to

intrinsic value. Anticipated population growth in Africa over the next twenty

years suggests market expansion potential, while acceleration in urbanization

suggests greater cost efficiencies and thus greater profitability.

- When making investments outside the United

States, investors should think about performance ex-currency. A strong dollar negatively

impacts overall performance, even as fund managers like Nile Capital Management

have historically demonstrated solid stock picking and portfolio management.

- In terms of allocating to Africa, we believe that

clients should consider that Africa today represents 4% of global GDP and is

expected to grow to about 12% of global GDP over the next twenty years. Also,

we believe that an active management approach to investing, such as that used

by Nile Capital Management, can potentially drive wealth for investors over the

long term.

http://www.moneylifeshow.com/SaveFiles1/Upload_Files/151208%20-%20Big%20Interview%20with%20Larry%20Seruma.mp3

Nile Capital

Management

We Know Africa:

From Cairo to Cape Town

For more

information please call

646-367-2820