Last week saw some volatility in

the US markets, with the S&P 500 functioning like a seesaw. The week of

8/24 started off down 5% between the previous Friday’s close and Tuesday’s

close, but then rallied between Tuesday’s close and Friday’s close. All-in, the

week closed up almost 1% from the previous week’s close.

So what drove the volatility,

particularly the rally as the week progressed? The Bureau of Economic Analysis

released a revised second quarter GDP of 3.7% for the United States, beating

the forecasted uptick of 3.2%. Personal consumption was up a healthy 3.1%.

We believe that fundamentals in

the US are generally sound. The most recent housing starts data released by the

US Census Bureau revealed that month-to-month July housing starts were up 0.2%

and year-over-year starts were up 10.1%. Consumer spending, which drives about

70% of the US economy, rose 0.3% for July, while disposable personal income

rose 0.5%. Core PCE prices (excluding food and energy) increased 0.1%.

Speculation continues as to

whether the US Fed will increase rates in September. We believe that this is

highly unlikely. Consumer spending has not gotten out of hand, with the US

personal savings rate ticking up to 4.9% in July, up from 4.7% in June. And, as

we noted, core PCE prices (a measure of inflation) is minimal. Moreover, the

dollar continues to remain strong: a rate hike will only further strengthen an

already strong dollar, leading to further weakening and devaluation of other

currencies. We are very much a one-world economy now.

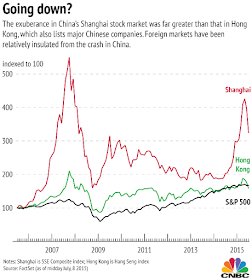

To offset the devaluation of the

yuan, China sold from its stockpile of US Treasuries last week. Estimates

suggest that China controls about $1.48 trillion of US government debt. Our understanding is that China sells its US Treasuries to

the market in USD, and then uses those dollars to buy back the yuan, driving up

demand for the yuan and strengthening the yuan relative to the USD. We find it

unlikely that these actions by the Chinese government to stabilize their

currency will be the driver for the Fed to increase rates in September. The

effect, if any, will be through the currency channel where the dollar will be

weaker.

So again we ask what are the

implications of all this for Africa and the global frontier markets? Local currencies and valuations have come down nicely,

suggesting nice long-term opportunities for US investors, which active managers

like Nile Capital Management are well-positioned to take advantage of. We believe

this is an ideal time to allocate to frontier and emerging markets.

The views expressed are opinions subject to

change and are not investment advice

Nile Capital Management

We Know Africa: From Cairo to Cape Town

For more information please call 646-367-2820