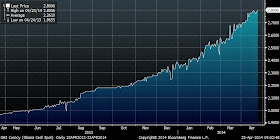

chart courtesy of Bloomberg Finance L.P.

|

| Ghanaian Cedi vs. U.S. Dollar |

- The Ghanaian

government has failed to reign in the country's fiscal and current account deficit, and

the Cedi (Ghanaian currency) is down about 20% Y-T-D.

- We don’t believe the

measures taken to date will be sufficient to stem the weakness in the GHS

performance relative to the dollar.

- According to

Standard Bank, the forth coming bond auction is likely to see yields in excess of

26-28% from foreign investors – and the government is likely to accept such high

rates.

Nile Capital Management

We Know Africa: From Cairo to Cape Town

For more information please call 646-367-2820