Recently, global markets have been concerned over a Eurozone recession, and the health of the world’s Developed economies. In particular, worries over debt levels in the European Union have led many investors to fear for the health of the monetary union and become wary about global growth.

Given concerns over slow economic growth rates in the US and Euro Zone as well as high leverage in these regions, we believe that investors are seeking to diversify their holdings into an increasingly globalized allocation. In particular, many clients are looking for greater exposure to the expected centers of global growth in coming years, which means allocating more capital to emerging economies. We believe it is important from a diversification standpoint to look beyond some of the most high profile emerging economies in order to truly participate in the broader sources of the world’s economic growth.

To that end, we believe that Africa's potential for strong, long term growth (both in terms of economic expansion, as well as increasing consumption) and low correlation to other global markets makes it a compelling investment allocation in a global portfolio. In fact, the economic growth rates of many of Africa's nations are expected to be some of the highest in the world in coming years. Trends such as demand for natural resources, infrastructure development, and an expanding consumer market are all likely to support Africa’s economic growth for years to come. At the same time, Africa's twenty-four capital markets have generally demonstrated not only a low correlation of returns with other global exchanges, but also a low correlation between one another. This means that adding Africa to a global portfolio has the potential to provide your clients with exposure to strong, low-correlated growth in the coming years.

We believe utilizing Nile’s Africa fund vehicle as part of a global portfolio is an excellent way to capture the opportunity which Africa presents. Nile’s active strategy, which is is underpinned by our Portfolio Manager’s twenty years of experience and familiarity with investing in Africa, should provide us access to compelling opportunities across the Continent. Nile’s expertise may prove to be an essential aspect to allow you and your clients to successfully navigate Africa’s capital markets. Nile’s Portfolio Manager travels to Africa frequently to conduct research, and we maintain contact with a network of on the ground analysts who provide research and information about securities in which we may consider an investment. In addition, we are a US registered investment adviser headquartered in New York City and believe that transparency is key in the current investment environment.

One key reason why Africa continues to be an excellent opportunity for investment is its low correlation to other global exchanges. In fact, over the past few years the correlation has been low enough to compare to US stocks and US bonds. Although in periods like we are currently experiencing, correlations across global markets tend to converge as investors pare risk globally in response to concern over weakness in the developed world. Recently, Fidelity published an article which noted precisely how low this correlation had been over the past few years and demonstrates the opportunity for diversifying a portfolio through an investment in Africa.

(The original draft of the Fidelity article can be found here: https://guidance.fidelity.com/viewpoints/africa-next-growth-story)

However, although Africa’s exchanges may have seen weakness in recent months, we continue to feel that the Continent maintains a significant deal of independence from global business cycles. For example, consumption patterns in Africa have continued to trend upwards, with expansion of the number of middle-income consumers continuing to drive growth. While markets may in fact have fallen as a result of reduction of risk, this does not mean that the fundamentals of the companies that trade there are correlated to changes in global stock markets. We believe the current weakness in global markets as an important opportunity to allocate funds to Africa, and the valuations of the firms in which we invest, which were already compelling, have become even better in our view.

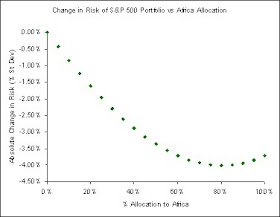

In addition, a good deal of the appeal of investing in Africa comes down to the potential which it provides for investors to diversify their allocations, and decrease the overall volatility of their portfolio. If an investor chooses to put money in Africa, and Africa continues to demonstrate low correlation, this means that the overall volatility of the investor’s portfolio could actually go down, even while funds are allocated to a place which is traditionally considered more ‘frontier.’ In fact, we have actually found that adding an allocation to Africa in a portfolio comprised exclusively of the S&P 500 has led to an overall decrease in risk over time.

Source: Bloomberg; African Data Includes South Africa, Nigeria, Kenya, Mauritius, Ghana, Egypt, Morocco, Botswana, through 12/2009.

Finally, we believe that concerns over currency fluctuations have weighed heavily in the minds of some investors in recent months. We believe that the recent weakness in emerging market currencies has been driven by investors’ desire to decrease exposure to risk in the face of uncertainty over the situation in the Euro Zone. Outflows from these currencies has driven many of them lower in the past few weeks, however we believe that over time the situation will re-adjust. Over the longer term, we still believe that there is a trend towards appreciation of emerging market currencies against the US dollar. In fact, we would argue that capital inflows and strong growth are an inevitable long-term result of Africa’s emerging consumer base.

Thus, we believe that now is an excellent time to consider capitalizing on global market weakness to invest in a region which will provide low correlation, strong economic growth, and a strong recovery.

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com

We know Africa: From Cairo to Capetown