About Money Watch Africa

March 23, 2011

A Welcome Sign: Egyptian Market Resumes Operations

March 18, 2011

World Bank Economist: Africa on the Brink of a Takeoff

March 15, 2011

Why is the Egyptian Market (Still) Not Open?

March 10, 2011

Africa: The Best Ground Floor Opportunity for Returns Over the Next Twenty Years

So with that as a back drop, I think there are some merits to Larry's fund. Having just completed my second visit to Africa (Kenya), I can tell you that there is a lot of activity going on there. Everyone has a cell phone; and since only 10% of Kenyans have a bank account, a common method of money transfer is to send credits from one cell phone to another - the recipient just goes into a local convenience store and collects the cash. Cell phone reception in the middle of the African veldt is better than it is between Bend and Portland, Boise or Reno. I could seamlessly draw money out of my U.S. bank accounts through African bank ATM's. I know of no other markets that are as underdeveloped as Africa; Thailand, Mexico, South America and Asia are at least one decade ahead of where Africa (with the exception of South Africa) is today - the point is, if you want a truly 'emerging market', Africa provides the best ground floor opportunity to potentially see some incredible returns over the next twenty years."

For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com

March 7, 2011

Investing in Africa Can Reduce Risk in a Portfolio

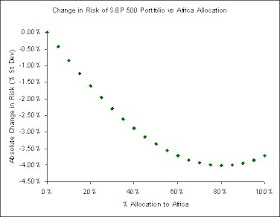

Diversification has long been known as a key for investors who are looking to minimize risk (take a look here for a great explanation). Investing in more than one security, sector, or region means that individual winner and losers in a portfolio can balance against each other over time. Although nobody can predict the market's performance, over time it has been shown that different assets do not necessarily rise or fall in sync. The adage of 'safety in numbers' is apt - were one investment to fall, you hope to have others whose performance is not correlated and who can prove protective in your portfolio.

This may not seem to jive with the high risk premiums investors ascribe to Africa, which are often driven by turbulent political conditions or underdeveloped capital markets. However, it turns out that because African markets have historically not been linked to the performance of other global markets, they can actually serve to decrease investment risk. In fact, because Africa is comprised of a number of individual equity markets which do not necessarily move together, the risk is likely to be lower than any other individual Emerging market.

Take a look at what an African investment could do for risk in a U.S. portfolio. Note: we make the assumption that the S&P 500 represents the average holding portfolio for most U.S. investors.

So imagine, for example, adding a 30% allocation to Africa in a portfolio (for the sake of argument, call 'Africa' a composite of South Africa, Nigeria, Kenya, Mauritius, Ghana, Egypt, Morocco, and Botswana).

So imagine, for example, adding a 30% allocation to Africa in a portfolio (for the sake of argument, call 'Africa' a composite of South Africa, Nigeria, Kenya, Mauritius, Ghana, Egypt, Morocco, and Botswana).  Between the end of 2001 and the beginning of 2010, the composite would have an annualized return of 8.85%, with a annualized standard deviation of 13.05%. This compares with the S&P alone, which would have lost 0.36% on an annualized basis, with 15.61% volatility. Perhaps not what you would expect.

Between the end of 2001 and the beginning of 2010, the composite would have an annualized return of 8.85%, with a annualized standard deviation of 13.05%. This compares with the S&P alone, which would have lost 0.36% on an annualized basis, with 15.61% volatility. Perhaps not what you would expect. For more information about investing in Africa, please contact Nile Capital Management at (646)367-2820 or info@nilecapital.com